SYNOPSIS

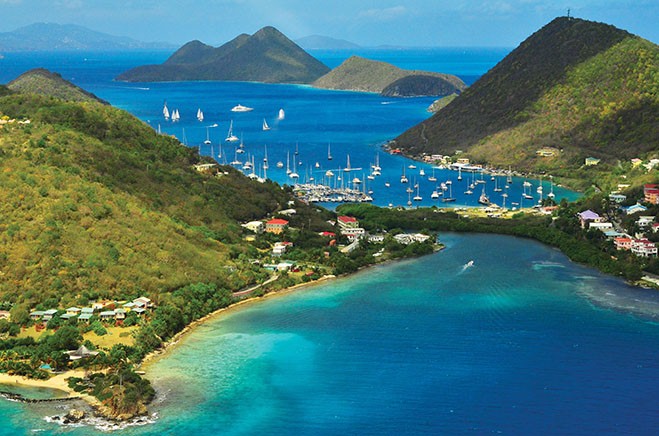

The British Virgin Islands are a British dependency located in the Eastern Caribbean about 80 kilometers East of Puerto Rico. English is the official language and the official currency is the United States Dollar. The Government is stable and promises to remain that way. There is good commercial and professional infrastructure and the Government is actively encouraging the development of the offshore finance business and has now upgraded the Companies Registry by installing state of the art technology.

The International Business Companies Act was passed in 1984 and created the International Business Company (IBC) which is the preferred offshore company vehicle. In recent years the BVI has become extremely popular, particularly in the Far East region due to the extensive marketing of the jurisdiction particularly by lawyers who moved from Panama during the Noriega regime and set up offices in the BVI.

A BVI IBC has the following characteristics:

Shareholders:

A minimum of one shareholder is required and are issued shares in registered form only. No details of the shareholders appear on the public file but a register of shareholders must be kept at the registered office address of the company in BVI. Corporate shareholders are permitted.

Directors:

A minimum of one director is required and corporate directors are permitted. Details of the directors do not appear on the public file.

Officers/Secretary:

A company secretary is not a requirement under the Act, but a secretary is normally appointed to facilitate signing obligations.

Restrictions on Name and Activity:

Names must end with one of the following words or abbreviations thereof – Limited, Corporation, Incorporated, Societe Anonyme or Sociedad Anonima.

The following words and their associated activities cannot be used: Assurance, Bank, Building Society, Chamber of Commerce, Chartered, Co-operative, Fund, Imperial, Insurance, Municipal, Mutual Fund, Royal and Trust.

Local Requirements:

As a matter of local company law the company MUST maintain a registered office address within BVI and must also appoint a BVI resident as registered agent. We would generally provide these services as part of the domiciliary service fee.

All companies to keep accounting records that “are sufficient to show and explain the company’s transactions; and will at any time enable the financial position of the company to be determined with reasonable accuracy.” When the records are not kept at the office of the company’s registered agent the company is responsible for providing the agent with a written record of the physical address where they are kept. If such location changes the company must notify the agent of the new address within fourteen days of the change.

Timescale:

Incorporation can be achieved within 24 hours. However, it does take approximately 1 week for legalization of documents in BVI. We do keep ready-made companies in stock available for immediate purchase.

Annual Reporting:

No annual return or accounts need be filed. It should be noted that penalty fees upto 50% of the annual Government fee will be incurred if the license fee is not paid when due. In case of non-renewal of company beyond permitted period the company may be struck off by the authorities.

Taxation:

IBCs pay no taxes in BVI

Secrecy:

There are no specific statutory provisions governing secrecy in relation to companies but English Law which applies within the jurisdiction does impose a common law duty on professionals to keep the affairs of their clients confidential.

Company Renewals:

Renewal for BVI Companies will fall depending on the date of incorporation as per below:

Company Anniversary date between: Due date:

January to June (1st half) Before May – 31st

July to December (2nd half) Before November – 30th

In case of late renewal, government and service charges shall be applicable.

The company will be struck off by the registrar if not renewed within five (5) months after the due date and restoration fees shall be applicable.

Latest valid passport copy and recent utility bill for address proof of shareholder/director are required to be submitted at every renewal as a part of enhanced due diligence. If shareholder is a corporate entity, then latest certificate of incumbency and above stated docs of directors would be required.

Documents Required:

KYC Documents for individual Director/Shareholder

- Passport copy

- Proof of address (dated less than 3 months)

- Bank reference (dated less than 3 months with satisfactory record clearly mentioned and also the time period the client has been dealing with the bank: minimum of 2 yrs)

- Detailed CV

- Professional reference

KYC for Corporate Director/Shareholder

- Certificate of Incorporation

- Registered address and place of business

- Certificate of Current Standing if incorporated more than 1 year

- Register of Directors

- Register of Shareholders

- Memorandum & Articles of Association

Whilst every effort has been made to ensure that the details contained herein are correct and up-to-date, it does not constitute legal, tax or other professional advice. We do not accept any responsibility, legal or otherwise, for any errors or omissions.